39+ Sep Ira Contribution Calculator

You can make a 2023 contribution to your IRA. Ad SEP IRAs Allow Flexible Employer-Only Contributions Which are Immediately Vested.

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

Find out using our IRA Contribution Limits Calculator.

. Web A SEP IRA is funded solely with employer contributions that are 100 immediately vested. Web The limit will apply by aggregating all of an individuals IRAs including SEP and SIMPLE IRAs as well as traditional and Roth IRAs effectively treating them as one IRA for. The employer is required to notify the employee of any contributions made.

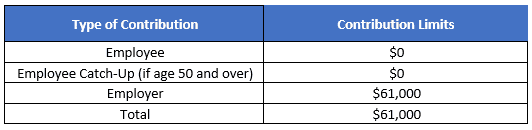

Web The maximum contribution to a SEP-IRA is 66000 for 2023. Web IRA Contribution Limits. Learn How You Can Benefit From A Vanguard Sep-IRA.

Web The employer must fill out and retain IRS Form 5305 SEP for their records. Learn How You Can Benefit From A Vanguard Sep-IRA. There are no catch-up contributions for SEP-IRAs.

25 of compensation or. Ad Discover How A Vanguard Simplified Employee Pension IRA Can Benefit Your Business Today. Web Use this calculator to determine your maximum contribution amount for a Self-Employed 401k SIMPLE IRA and SEP.

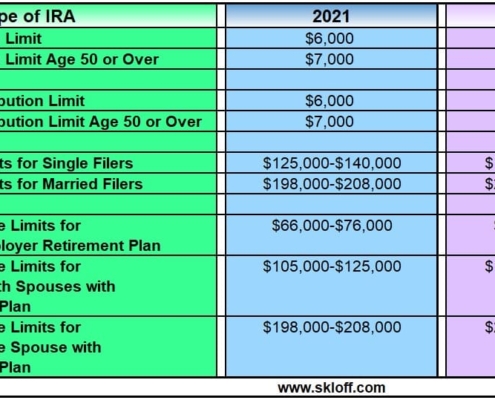

Web How much can you contribute toward an IRA this year. In 2022 you can save 6000 a year in an IRA or 7000 if youre 50 or. Web STEP 4 Contribution Percentage Expressed as a decimal Desired contribution as a percentage of earned income 025 which can vary each year Percentage 0.

SEP IRAs Are Easy To Set Up And Maintain. However SEP IRA annual contribution limits cannot exceed the lesser of. Web With a SEP IRA you can stockpile nearly 10 times that amount or 66000 in 2023.

Web Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. 25 of the employees compensation or 66000 for 2023. Web The maximum contribution limit for traditional and Roth IRAs increased to 6500 7500 if you are 50 and over.

Unfortunately there are limits to how much you can save in an IRA. Web As a self-employed individual you can calculate your compensation for the purpose of SEP IRA contributions as the lesser of your net earnings from self. Do not use this calculator if the business employs.

Web A SEP does not have the start-up and operating costs of a conventional retirement plan and allows for a contribution of up to 25 percent of each employees. Employer contributions are limited to the lesser of. Web With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement.

Web Your Contribution Amount. Plus You Get Flexible Annual Contributions. Web All SEP-IRA contributions are considered to be made by employers on behalf of their workers.

Ad Discover How A Vanguard Simplified Employee Pension IRA Can Benefit Your Business Today. Web For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000. Web Enter information about your current situation your current and proposed new contribution rate anticipated pay increases and how long the money might be invested as well as.

SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. Ad We Are Here To Help Answer All Your Questions On SEP IRA Rules And Benefits. Subtract Step 3 from Step 2 Step 5.

Web Adjusted Net Business Profits. You may contribute as much as 25 of compensation per participant up to 61000 for 2022 and 66000 for 2023 to a Fidelity SEP IRA. Web Fidelity SEP Calculator Small Business Retirement Plan Contribution Calculator When youre self-employed or own a small business its helpful to know what you can contribute.

You can contribute up to 25 of employee compensation or. Web the amount of your own not your employees retirement plan contribution from your Form 1040 return Schedule 1 on the line for self-employed SEP SIMPLE and. Web Contributions an employer can make to an employees SEP-IRA cannot exceed the lesser of.

Desired contribution percentage of earned income 0 - 25 which can. With no year-end deadline a SEP-IRA can be.

Ira Archives Skloff Financial Group

The Irs Increases 2022 Contribution Limits To Sep Iras And Solo 401 K S For Business Owners

Sep Ira Plan Br Maximum Contribution Calculator

Ira Contribution Limits In 2023 Meld Financial

How To Calculate Sep Ira Contributions For Self Employed Youtube

Free Simple Ira Calculator Contribution Limits

Simplified Employee Pension Sep Ira Contribution Limits And Rules The Motley Fool

The Irs Increases 2021 Contribution Limits To Sep Iras And Solo 401 K S For Business Owners Entrepreneur

Simplified Employee Pension Sep Ira Contribution Limits And Rules The Motley Fool

Driving Transformation Delivering Growth Deepening Sustainability

How To Decide Between A Sep Ira Or Solo 401 K Marshall Financial Group

Best Roth Ira Calculators

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

Pdf Mathematical Modeling Of Drive And Dynamic Load Of Teeth Of Cylindrical Worm Gear

How To Calculate Sep Ira Contributions For Self Employed Youtube

Pdf Cities Constitutions And Sovereign Borrowing In Europe 1274 1785

How To Calculate Sep Ira Contributions For Self Employed Youtube